Should You Sell Your Vacant Land Before Year-End?

Pennsylvania Property Owners' 2025 Tax & Financial Guide

The Question Thousands of Pennsylvania Property Owners Are Asking Right Now

It's mid-November. Property tax bills have arrived. The holidays are approaching. And you're sitting with a piece of vacant land in Pennsylvania that you haven't visited in months—maybe years.

You're not alone in this situation. According to recent market analysis, Pennsylvania has thousands of vacant land parcels with stagnant demand, and many owners are living out-of-state and facing the same question you are:

"Should I sell this land before December 31st?"

The answer depends on your specific situation—but for many Pennsylvania landowners, the next 6 weeks represent a crucial window of opportunity that could save you thousands in taxes, eliminate ongoing expenses, and free up cash before 2026 begins.

Let's break down exactly what you need to know.

Why November-December Is Decision Time for PA Vacant Land Owners

📅 Year-End Tax Implications Matter

When you sell property, the tax year in which the sale closes can significantly impact your financial situation. According to the IRS (IRS Topic 409: Capital Gains and Losses), selling before December 31st means:

- Capital gains or losses are reported on your 2025 tax return (filed in April 2026)

- Potential to offset gains with losses from the same tax year

- Opportunity to plan deductions before year-end tax deadlines

- Clarity for 2026 financial planning rather than carrying property into another tax year

Real Example: If you're also selling stocks or other investments in 2025 at a profit, selling your vacant land at a loss could help offset those gains, potentially lowering your overall tax burden.

🏠 Pennsylvania Property Tax Reality

Pennsylvania property taxes are consistently higher than the national average. According to Tax-Rates.org (Pennsylvania Property Tax Data), the state's average effective property tax rate is 1.35% for 2025—significantly higher than many other states.

What this means for you:

- A vacant parcel assessed at $50,000 costs you roughly $675/year just in property taxes

- Over 5 years of ownership, that's $3,375 with zero return on investment

- 2026 tax bills will likely be higher due to ongoing assessment increases in many PA counties

- Pennsylvania ranks 16th in the nation for average property taxes collected

Year-end is approaching, and this is a good time to review whether it still makes sense to hold the property into 2026: Property tax due dates in Pennsylvania vary by county and school district, but many bills are due between mid-year and December 31st. If you still own the property going into 2026, you can expect another tax bill tied to that year.

❄️ Winter Maintenance & Liability Concerns

Pennsylvania winters are harsh. Vacant land faces:

- Fallen tree liability from ice storms and heavy snow

- Trespasser risk when properties are harder to monitor

- Erosion and drainage issues from freeze-thaw cycles

- Difficulty showing property to potential buyers in snow/ice

Insurance costs rise: Many vacant land liability policies run a few hundred dollars per year (often in the $300–600/year range depending on parcel size and risk).

Five Common Situations Where Selling Before Year-End Makes Sense

Situation 1: You Inherited the Land

What people are Googling: "What to do with inherited land Pennsylvania," "Sell inherited property before year end tax," "Inherited vacant land tax burden"

If you inherited land from a parent or relative, you might be experiencing:

- Emotional attachment mixed with practical burden

- Uncertainty about what to do with property you'll never use

- Ongoing tax bills eating into your inheritance value

- Family disagreements about whether to keep or sell

Year-end advantage: Selling before December 31st gives you a clean financial slate for 2026 and removes the emotional weight that often intensifies during the holidays.

Situation 2: You're Paying Taxes on Land You Never Visit

What people are Googling: "Sell vacant land Pennsylvania fast," "Out of state land owner sell PA," "Vacant land holding costs"

Many Pennsylvania vacant land parcels are owned by out-of-state residents who struggle with:

- Property tax bills that arrive but provide no value

- Inability to visit or maintain the property

- Concern about what's happening on land they can't see

- Administrative hassle from hundreds of miles away

Year-end advantage: Closing before December 31st means you enter 2026 tax-free from this property, with immediate cash that could fund investments, home improvements, or retirement savings.

Situation 3: Your Investment Hasn't Panned Out

What people are Googling: "Land investment losing money," "When to cut losses on land," "Sell land below market value"

You bought the land as an investment 5, 10, or 15 years ago. But:

- The area hasn't developed as expected

- Neighboring properties haven't improved

- Annual carrying costs exceed any appreciation

- You're tired of hoping for a market that may never come

According to recent market analysis, In many rural Pennsylvania counties, vacant land demand has been sluggish. It’s common to see lots discounted well below their assessed values, and some sellers wait many months or even years for a buyer, especially if they price near or above the assessed value.

Year-end advantage: Selling now—even at a loss—can provide tax benefits while eliminating the risk of another year of depreciation and costs.

Situation 4: Medical Bills, Debt, or Unexpected Expenses

What people are Googling: "Sell land fast for cash PA," "Quick land sale Pennsylvania," "Emergency property sale"

Life happens. Maybe you're facing:

- Medical expenses not fully covered by insurance

- Credit card debt you want to eliminate before 2026

- Unexpected home repairs or family emergencies

- Need for retirement fund contributions before year-end

Year-end advantage: A quick land sale can provide immediate liquidity, and closing before December 31st means you have cash in hand for year-end financial moves.

Situation 5: You're Simplifying Your Life

What people are Googling: "Downsize property portfolio," "Sell unused assets," "Simplify estate before retirement"

More Pennsylvania property owners (especially those 55+) are asking:

- "Why am I holding onto property I'll never develop?"

- "Do my kids even want this land?"

- "Could I put this money to better use?"

Year-end advantage: Selling before the holidays gives you a fresh start for 2026, reduces estate complexity, and provides peace of mind heading into a new year.

The Hidden Costs of Holding Vacant PA Land Through 2026

Let's do the math on what keeping your vacant land will actually cost you:

Annual Cost Breakdown for Typical PA Vacant Land:

Reality check: That's $7,875 over 5 years—money that could be earning returns in a retirement account, paying off debt, or funding home improvements you'd actually enjoy.

Understanding 2025 Capital Gains Tax for Land Sales

According to the Tax Foundation (Pennsylvania Tax Data), understanding your tax implications is crucial when selling property.

Long-Term Capital Gains Rates (For Properties Held Over 1 Year):

2025 IRS Tax Brackets:

- 0% rate: Single filers earning up to $48,350 | Married filing jointly up to $96,700

- 15% rate: Single filers $48,351-$533,400 | Married filing jointly $96,701-$600,050

- 20% rate: Single filers over $533,400 | Married filing jointly over $600,050

Short-Term Capital Gains (properties held 1 year or less): Taxed as ordinary income at rates from 10%-37%.

Key Point: Vacant land doesn't qualify for the $250,000/$500,000 primary residence exclusion—that's only for homes you've lived in for 2 of the last 5 years.

Note: This article provides general information, not tax, legal, or financial advice. Always confirm your specific situation with a CPA or tax professional.

How Land Avion Makes Year-End Land Sales Simple (Even With 6 Weeks Left)

Here's the concern we hear most: "It's already mid-November—is there even enough time to sell before year-end?"

The answer: Yes—but only if you work with a direct buyer who can close quickly.

The Land Avion 3-Step Process:

Step 1: Get Your Cash Offer (24-48 Hours)

- Submit your property details online or call us

- We research your land and provide a fair, no-obligation cash offer

- No waiting, no uncertainty—just a clear number

Step 2: Accept & Schedule Closing (Your Timeline)

- If you accept, we handle ALL paperwork

- You choose the closing date (we can close in as little as 14 days)

- We pay all closing costs—you pay nothing

Step 3: Get Paid (Cash at Closing)

- Close before December 31st for year-end tax benefits

- Walk away with cash in hand

- No more property taxes, no more liability, no more stress

What Makes Land Avion Different?

We know Pennsylvania. We buy vacant land (and houses) across the state—from rural Potter County to suburban Philadelphia counties. We understand:

✅ Pennsylvania property laws and tax implications

✅ Rural land challenges (access, utilities, zoning)

✅ Multi-generational inheritance situations

✅ Out-of-state owner frustrations

What we offer:

- No realtor commissions (save 6% immediately)

- No hidden fees or costs (we cover closing costs)

- Cash offers (no financing contingencies to delay closing)

- Fast closings (we can close before year-end)

- As-is purchases (no cleanup, repairs, or improvements needed)

Real Questions Pennsylvania Landowners Are Asking

"Will I lose money selling to a direct buyer vs. listing with a realtor?"

Not necessarily. Consider:

- Realtor commissions: 6% of sale price

- Listing time: 6-12 months average for vacant land (you pay 2026 taxes)

- Holding costs during listing: $1,575+

- No guarantee of sale

With Land Avion:

- $0 commission

- Close in weeks, not months

- Guaranteed closing

- Cash in 2025, not 2026

Want to understand more about the real costs? Read our detailed guide on The Real Cost of Holding Onto Unwanted Property.

"What if my land has back taxes or liens?"

We work with properties that have back taxes. Often, we can still make an offer and coordinate with the county to resolve tax issues at closing.

"Can you really close before December 31st?"

Yes. Our record is 12 days from offer acceptance to closing. If you contact us by early December, we can absolutely close before year-end.

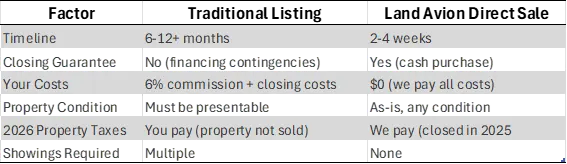

Traditional Listing vs. Direct Sale: The Facts

Still wondering about your options? Here's what you need to know:

For a deeper comparison, check out our article: Fast vs Traditional Land Sales: Which Option Is Right for You?

Decision Time: Your Next Steps

November and December are not "slow months" for land sales—they're opportunity months for smart property owners who want to:

✅ Enter 2026 tax-free from unwanted property

✅ Turn unused land into immediate cash

✅ Eliminate ongoing costs and liability

✅ Make year-end financial moves with confidence

✅ Simplify their lives before the holidays

Get Your No-Obligation Cash Offer Today

If you’d like to close before year-end, there’s still enough time as long as you get the process started. If you reach out now, we can make it happen.

Here's what to do next:

📱 Call or Text: 979-269-7323

📧 Email: [email protected]

🌐 Visit: www.landavion.com

No pressure. No obligation. Just honest answers and a fair cash offer.

We buy vacant land and houses across Pennsylvania. Whether your property is 1 acre or 200 acres, paid off or with back taxes, in the Poconos or near Pittsburgh—we'd like to make you an offer.

Let's talk before the year runs out.

About Land Avion:

Land Avion is an active Pennsylvania land buyer that helps property owners convert unused land and unwanted houses into immediate cash. We specialize in working with inherited properties, out-of-state owners, and landowners facing financial or life transitions. We pay all closing costs, work with your timeline, and make the selling process as simple as possible.

Related Articles You Might Find Helpful:

- 5 Common Fees You Can Stop Paying After a Cash Sale

- The Real Cost of Holding Onto Unwanted Property (Land or House)

- Fast vs Traditional Land Sales: Which Option Is Right for You?

Sources & References:

This article uses verified data from the following credible sources:

- IRS.gov - Official IRS guidance on capital gains tax and property sales (IRS Topic 409: Capital Gains and Losses)

- Tax-Rates.org - Pennsylvania property tax statistics for 2025 (Pennsylvania Property Tax Data)

- Tax Foundation - Pennsylvania state tax data and analysis (Pennsylvania Tax Data)

All statistics and figures cited in this article are from 2024-2025 data sources and represent current, verified information.